Behavioral Competitiveness™ Program

The Behavioral Competitiveness™ Program is aimed at senior executives and the C-level team. The aim of the program is to improve the valuation of a company by improving its competitiveness by focusing on the financial behaviors of its employees and managers and especially how these relate to those of its competitors.

The Behavioral Competitiveness™ Program extends the Behavioral Profitability™ Program by using its assessment structure to evaluate the financial mission and business outcome of the participants’ organization as a basis of utilizing the behavioral information to improve the overall competitiveness of the organization. It also adds another assessment, the Corporate Financial Outcome Assessment which provides a behavioral measure of corporate valuation and competiveness.

As well as showing the Leadership Outcome Type™ and Financial Signature® of each of the participants and how this will lead to the quite specific financial and profitability of the organization within the context of its business and competitive focus, the program also reviews the competitive situation of the company and how well its team behaviors will compete against those of other companies in the industry. The program includes the following:

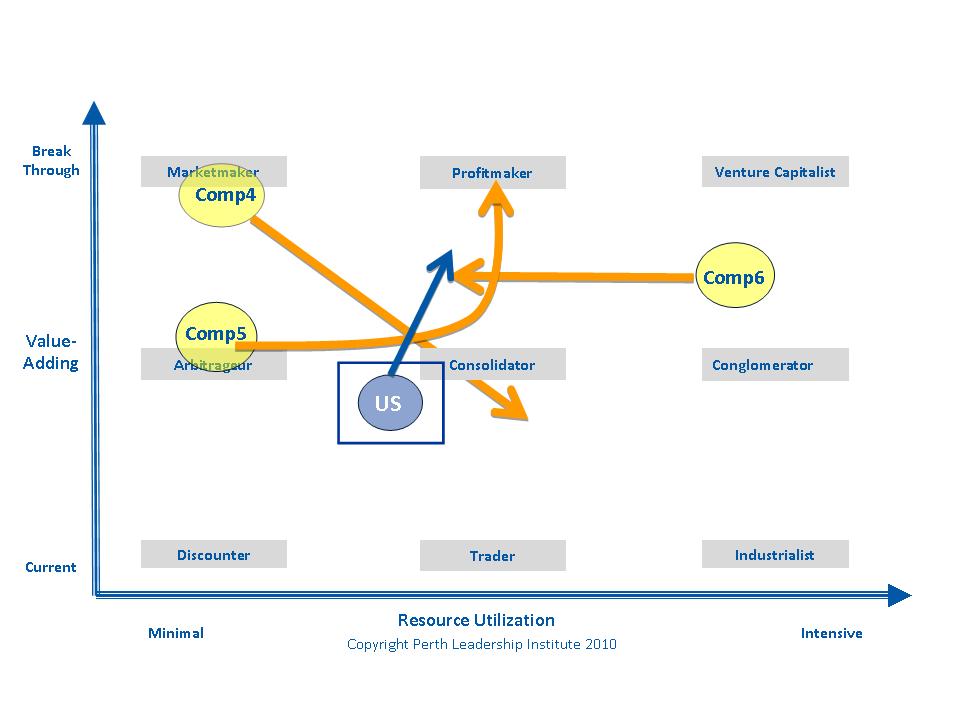

• Evaluation of the behavioral competiveness of other companies in the industry

• How well the current team will perform given these competitive behavioral dynamics

• Valuation implications for the company and its competitors.

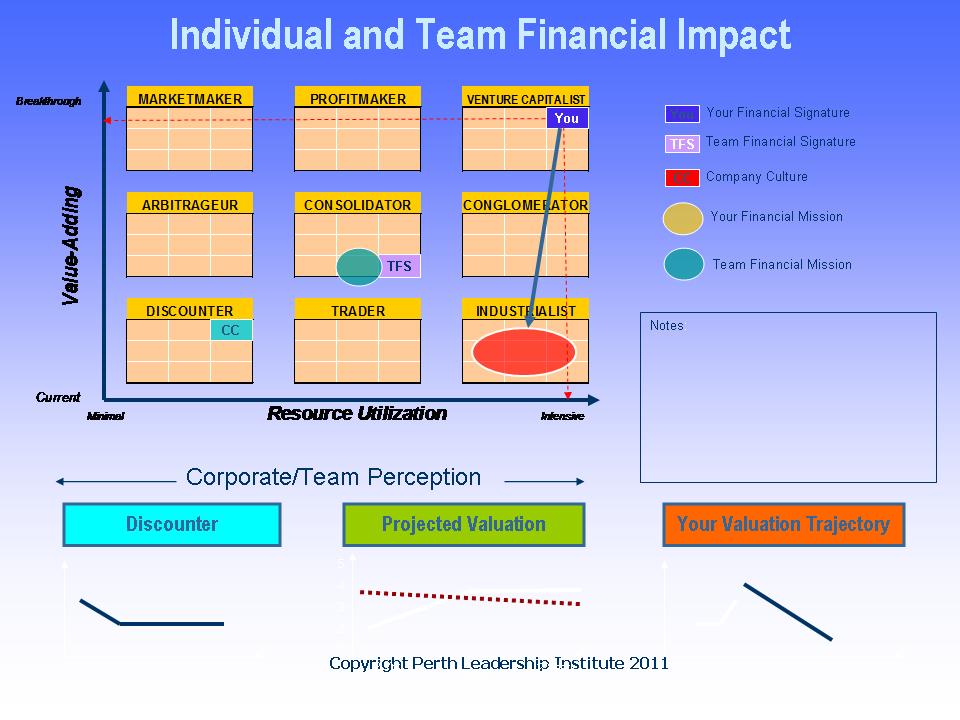

Each participant completes the Executive Outcome Assessment, the Financial Outcome Assessment and the Corporate Financial Outcome Assessment before the training commences. Each participant gets individual reports showing them their Leadership Outcome Type™, their Financial Signature®, their Financial Mission and the team assessment of the overall organization’s position based on competitive behavioral characteristics including the financial mission of competitors.

The program includes training sessions, interactive exercises and simulations designed to help participants digest the material and to understand how to put it to practical use.

The program lasts from two to three days.

The Behavioral Competitiveness™ Program

• Improves a team's profitability and financial performance.

• Aligns the financial traits of executives (Financial Signatures®) and managers with their company's financial performance targets

• Provides an assessment of each executive's and the leadership team's financial and leadership profiles

• Assesses their likely impact on achieving the desired financial performance target

• Identifies specific strengths, vulnerabilities and individual development possibilities

• Enables companies to more directly link executive assessment, development and team deployment to measurable business outcomes.

A Behavioral Competitiveness™ Program:

• Defines and measures competitive advantage through identifying the number and types of Financial Signatures® possessed by individuals in an organization relative to its competitors.

• Measures and improves the ability of the organization to expend its resources to accomplish competitive superiority.

The combination of these approaches leads to improved revenues, gross margins, profitability and cash flow and therefore to improved company valuation and market power.

A Behavioral Competitiveness™ Program aligns the Financial Signatures® of executives and leadership teams at all levels with the valuation objectives of the organization. This allows for the optimization of the organization's profitability and valuation through optimizing the membership and composition of senior management teams.

The purpose of the program is to assess each of the individual team members to arrive at a composite team profile and the impact of that profile on the valuation objectives of the organization. From this profile comes an identification of vulnerabilities, and corrective action needed.

The Behavioral Competitiveness™ Program provides value to every level of an enterprise:

Increases the valuation of the ENTERPRISE by ……

• Revealing where the company stands in relation to its competitors and their particular financial cultures in order to beat them in the market

• Choosing the right alignment process to best achieve the enterprise’s valuation goals

• Improving the organization’s financial culture to achieve its valuation goals.

Enables the CHIEF EXECUTIVE to.. …

• Understand how to adjust financial missions to surpass the competition and adjust to market threats

• Understand how to align the financial culture of the enterprise with valuation targets.

Enables the EXECUTIVE TEAM to …

• Understand how an executive becomes a valuation and profitability achiever

• Improve executive performance by helping them to align their operational missions to the valuation goals of the enterprise.

Strengthens HUMAN RESOURCES by …

• Aligning HR processes with the enterprises valuation and profitability goals

• Implementing the correct HR processes for achieving different levels of profitability

• Understanding how to develop executives with a winning Financial Signature®

Outcomes

• Improves individual capability to deliver improved financial performance outcomes

• Assesses "Nose for Making Money" and links executive behaviors to financial performance opportunities

• Leadership teams have increased clarity on how to achieve financial performance improvement in the context of the organization's financial goals.

• Stronger and aligned management systems and processes.

Summary Outcome: participants understand the extent to which their behavioral traits will help or hinder them in attempting to achieve competitive superiority and what to do to improve their performance in these areas.