The Private Equity Problem

The goal for private equity portfolios is to create outstanding financial value. But this must first be based on the right behaviors of management teams in portfolio companies.

The goal for private equity portfolios is to create outstanding financial value. But this must first be based on the right behaviors of management teams in portfolio companies.

The past record of an executive is not necessarily a good guide to future performance. So how do you predict performance of your executives in your portfolio companies? How do you link their behaviors in a precise way to likely financial outcomes? That means profitability, valuation and margins.

The Perth Leadership Behavioral Financial Solution

Perth Leadership has an innovative and cutting edge solution. It is based on over 10 years of research in the area of behavioral finance. It has developed a series of psychometric assessments possessed by no other organization in the world. These link executive behaviors to financial results.

Using this unique framework, we can provide you with forecasts of management financial results based purely on their behaviors. No need for intrusive background checks or private investigators.

Perth’s Behavioral Proforma™

Perth uses its psychometric assessments to prepare what it calls a Behavioral Proforma™. This is an income statement prepared just using behavioral data from both individual executives and the senior management team. This sets out likely results expressed as income statements using various behavioral scenarios.

Our Management Due Diligence program provides the following unique deliverables:

- Psychometric assessments

- Team Financial Outcome Analysis

- Individual Behavioral Proforma™ for all participants

- Team Behavioral Proforma™

- Team Training (optional)

- Individual Coaching sessions (optional)

An Innovative New Approach to Portfolio Management

The Perth approach opens up new portfolio management techniques. These techniques can only be adopted with a behavioral approach.

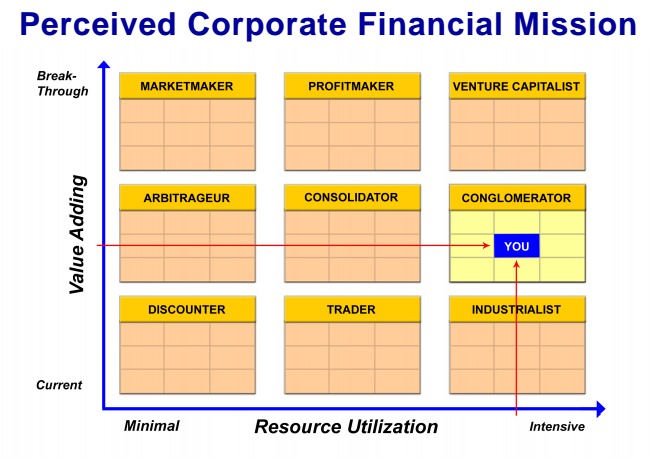

Where are your hidden profitability problems? Which executives have not been discovered who could super-charge your portfolio profitability? Which managers would be good for different types of businesses, companies and markets? The Perth approach provides cogent answers to all of these questions.

Now your can make more scientific decisions about hiring, firing and succession based on behavioral variables that are directly linked to financial results. So you don’t just have to rely on hunches, even if they are based on experience.

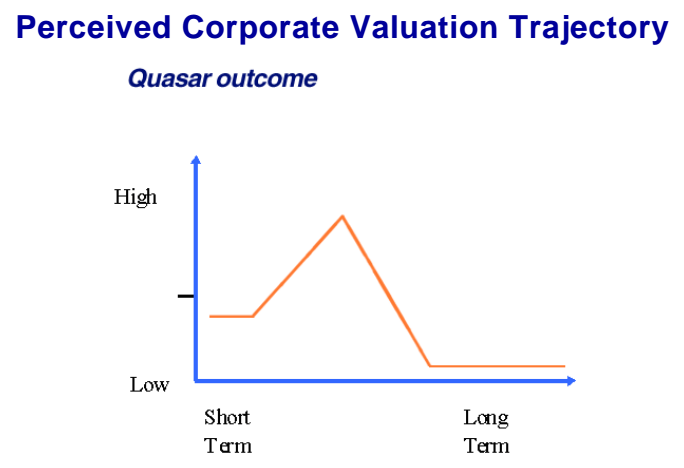

Plus now you can make other forecasts. In M&A transactions, what is the likely valuation resulting from different combinations of executives from the two companies What is the profit quality of the two management teams after the combination? How can the profit quality be improved?

A key factor in the Perth approach is that company managers can see that this approach can also help them improve their own performance in ways they never experienced before.

That is, portfolio managers can also be seen to be helping their company management teams in positive ways rather than just focusing purely on financial results. Another way to show they are adding management, as well as financial value.

The Benefits of Perth Management Due Diligence

- Profitability and valuation forecasts based on behavioral data instead of historical results.

- Alternative approach to valuation forecasts and portfolio management.

- New approach to performance management for private equity management.

- Provides support to company management that can help improve its own performance and career prospects.

| Do you want to read more? Click here to download: |