Background and History of Behavioral Finance and Business Acumen

Business acumen has emerged in recent years as a critical topic in leadership and management. This has been spurred by the financial crisis of the late-2000s and by increasing pressure on executives to produce higher returns, no matter what the financial environment.

But since business acumen is such a new issue, executives, leaders, shareholders, educators and researchers are still mostly unaware of its meaning, dimensions and where it fits into the pantheon of modern leadership, management, economic and financial thinking. This article attempts to address this gap.

Counter-Intuitive Findings in Business Acumen

Human brains are getting smaller; so how does this impact Big Data? E. Ted Prince on Perth blog

Sometimes you have to use less empathy rather than more... E. Ted Prince on "7 Strategies for Building Better Business Acumen" in HR West Magazine, November 2013, p. 13

Smarter people are more vulnerable to thinking errors- Journal of Personnel Psychology

Wikipedia quotes Dr. E. Ted Prince, on the difference between business acumen and financial literacy

"Leadership development must distinguish between business acumen and business literacy training in dealing with senior executives" - Perth White Paper

"It's Time to Rethink Continuous Improvement" - Too much TQM prevents innovation - Harvard

"The Genetics of Investment Biases?" Decision-making linked to genetic factors which explain up to 50% of investment biases.

"The New Science Behind Your Spending Addiction" Spending and brain wiring linked - Newsweek

"Activity of a single brain cell can predict if we spend or save" - Yale News

"The Curse of Knowledge" Ignorance can be beneficial and even necessary for the best decision-making - New Scientist

We can identify five strands in the emergence of modern business acumen thinking. These are:

- Entrepreneurship

- Personality theory

- Competency models

- Innovation

- Behavioral economics and finance

Entrepreneurship

Although usually described as a sociologist, Max Weber, who lived and worked in the late 19th and early 20th centuries, was really one of the first modern thinkers to discuss entrepreneurship. His seminal work was The Protestant Ethic and the Spirit of Capitalism. This linked culture to business; it essentially focused on the cultural and religious factors that drive entrepreneurship and business acumen.

Weber’s studies were extended in a more scientific manner by famous psychologist David McClelland, who showed the extent to which the need for achievement drives entrepreneurs. McClelland’s research was in many ways the precursor of research into behavioral economics, showing how unconscious drivers and biases were key drivers of business acumen.

The explosion of modern work into entrepreneurship attempts to isolate drivers of business acumen in order to improve entrepreneurial outcomes and to improve the success rates of businesses and startups. In large companies, the study of business acumen is frequently a means to train managers on how to regain the entrepreneurial drive and high growth rates that usually characterize early-stage companies.

Personality Theory

Personality theories are often linked with leadership traits and the ability to achieve leadership and hence business success. Karl Jung is usually credited with the development of the first personality theories. His theory of the collective unconscious, together with Sigmund Freud’s theory of the Id, again presage the idea of unconscious drivers of business acumen seen in new theories of behavioral economics and finance.

In the 20th century there was an explosion of personality assessments, based on Jung’s general ideas, but extended especially by the Five Factor model. This general approach is seen in many other personality models, including the FIRO-B, Myers-Briggs Type Indicator, Hogan Personality Inventory, Kolbe and others.

Although these models do not claim to measure business acumen directly, they do claim to be able to predict leadership success, which includes business success and thus are often regarded as being proxies for business acumen. This linkage is speculative since the assessments linked to these models were designed to assess interpersonal and thinking styles, which they do very well. However they were never designed to directly predict business outcomes, especially in financial and quantitative terms.

Competency Models

In the early 20th century a group of researchers, with the newly-minted name of industrial psychologists, developed what are now called competency assessments. Rather than a generalized model of personality which tries to identify general interpersonal and thinking skills, these models attempt to identify specific competencies. These assessments can then be used to predict performance by specific individuals in specific jobs. The best-known example is the DISC assessment .

Competency models were originally developed to predict how well particular workers would perform on manufacturing assembly lines. They were then extended to other jobs, mainly of a vocational rather than a managerial nature. Later they were extended to leadership assessment for executives. These assessments provide a fine-grained view of an individual’s professional and job competencies and can be very useful especially for more vocationally-oriented reviews.

However, at the level of leadership, these assessments can be difficult to interpret since they often have hundreds of competency categories. While they aim to predict leadership outcomes when used with senior executives, it is not clear that they actually predict outcomes as distinct from specific characteristics. Nonetheless, they are often used to infer business acumen based on the volume of psychometric information they provide since until recently there has been no other way to achieve this. It goes without saying that they too, like personality assessments, were never designed for this purpose so they should not be used in this way. Even if they are, they cannot provide direct information of this nature.

Innovation

As the concept of business acumen emerged in the early days it was seen as being synonymous with financial literacy and profitability. However more recently it has increasingly been seen that business acumen is less about profitability than about value creation. Since at its best, value creation involves innovation, it has become increasingly clear that business acumen in its optimal usage is also integrally linked with innovation.

The idea of innovation and entrepreneurship was championed by Joseph Schumpeter in the early 20th century with his famous identification of the process of creative destruction. This was the basis of a continuous cycle of innovation which catalyzed the next business cycle. In this model, value creation coupled with business acumen powered new products, companies and economies.

There have been attempts at measuring creativity such as the Watson-Glaser test, but current thinking has now tended to conclude that innovation and creativity are totally different things and should not be confused. But in researching entrepreneurialism and startups particularly in high-tech companies, the realization has been that innovativeness is critical to high levels of creation of capital and that a high level of innovativeness is usually associated with the highest levels of business acumen.

This is because this level of innovativeness results in the creation of the highest levels of product value and thus in very high gross margins, which are critical to high levels of profitability and capital creation. Perth specifically integrates a measure of innovativeness into its definition and measurement of business acumen.

Behavioral Economics and Finance

The most notable advances in economics in the 2000s have been the emergence of behavioral economics and behavioral finance. These have revolutionized the disciplines of economics and finance by dropping the assumption that humans always make rational decisions. They postulate, based on a huge amount of both empirical and scientific evidence and research, that many if not most economic and financial decisions are driven by unconscious cognitive biases that result in many or most decision outcomes to be flawed, or at least sub-optimal. The original work by Daniel Kahnemann and Amos Tversky led to the former receiving the Nobel Prize for Economics in 2002.

The emergence of this new paradigm is leading to a sea change in the study of business acumen. It has become increasingly clear that business acumen cannot simply be seen as being mastery of financial information and concepts, at least not at a conscious level.

Instead, business acumen comprises, at the very least, a set of powerful behaviors of which an individual is generally not aware. Business acumen is linked with unconscious cognitive biases that systematically distort one’s decisions in a particular way that leads to characteristic financial outcomes. These can be good but are mostly the opposite which neatly explains why most people don’t make money, even if they are highly educated, highly intelligent and very well schooled in matters economic and financial.

It is particularly the issue of the unconscious nature of drivers behind financial and economic behaviors that have led to the realization that, in order to train people in business acumen, they have to be assessed scientifically so that their unconscious cognitive biases can be identified and measured. Then we can get a precise handle on their level of business acumen and the financial outcomes it will likely lead to. This can then form the basis of both team and customized training and coaching in business acumen.

Another insight into business acumen from behavioral economics and finance is that we have to look directly at financial outcomes in a quantitative way. It is not enough to try to understand the characteristics of business acumen; this only becomes useful if we can directly link these characteristics with quantified financial and other business outcomes. In particular, our aim should be to predict their impact in quantitative terms on financial statements that issue from a company. This is a key part of the Perth approach.

This also leads to a link to the Balanced Scorecard (BSC) approach. This approach looks at business outcomes using a variety of business metrics. These go beyond just financial metrics to those involving matters such as growth, R&D, talent development and learning.

But the issue arises as to what specific types of behaviors drive BSC outcomes and metrics? And are these just at a conscious level of also unconscious, as is suggested by behavioral economics and finance?

In other words, the realization has been that in order to achieve outcomes that are desired and optimal using the BSC approach, we need to understand the behaviors that drive target BSC outcomes. Thus in order to drive optimal BSC targets, we need to be able to link business acumen to it since unconscious behaviors are going to be as or more important drivers than conscious behaviors and conscious decision-making.

That means that we cannot just view BSC training as being something that just focuses on formal, conscious processes as the way to achieve them. It must also include unconscious behaviors including unconscious cognitive biases. So the BSC and business acumen approaches are gradually converging.

We have shown above the intellectual strands that have combined to lead to the insights we now possess into what business acumen is. There have been three main stages in the historical development of business acumen as it applies to leadership development:

Stage 1 The Postwar Boom and Interpersonal Leadership

The Economic Environment: The postwar boom can be dated from 1945 until 1987, when the largest stock market crash since the Depression occurred. The postwar boom led to an explosion of the Western economies. In growth environments, it was relatively easy to make money. So this era was one of great optimism.

Impact on business acumen: In boom situations, no special business acumen is required since everyone makes money. Since even people with no business acumen make money, they erroneously believe they possess it. In this situation, there is no special need to focus on business acumen since companies are doing so well anyway. In this stage, to the extent that business acumen was invoked at all, it was seen as being purely a facility with figures and an ability to deal with accounting and finances. Thus business acumen in this stage was seen as being synonymous with financial literacy.

Impact on Leadership development: The major problems are dealing with growth and over-optimism. Many leaders suffer from hubris and mistreat their employees and followers. Leadership development focuses on soft skills to improve interpersonal skills. Training is based on personality assessments in order to target improvement in interpersonal skills. If you were a good leader according to these assessments, then you would automatically get good business and financial results, merely as being a good leader. So no business acumen training was necessary which was fine since it did not exist.

Stage 2 The Era of Busts and Rational Leadership

Economic Environment: We can date this era from 1987, the Black October Crash until the financial crisis which was recognized with the fall of Lehman Brothers in 2008. This era was one of busts and recessions followed by break-out attempts which continued to fail.

These include the 1987 stock-market crash and the subsequent breakout which culminated in the recession of the early 1990s. This, in turn, was followed by another breakout which culminated in the fall of Long-Term Capital Management in 1998 and the Asian financial crisis of 1998. Then there was another fast breakout culminating in the Tech Boom of 1999-2000 and the Tech Bust of 2001. The final breakout lasted until 2007-8 and finished with the financial crisis of 2008.

This period was characterized by the growing recognition of the boom-bust phenomenon. The optimism of the prior era leads to increasing skepticism and caution with the increasing frequency of the busts and their increasing severity.

Impact on business acumen: Here being a good leader was seen to be a way to get good financial results as long as you understood the formal disciplines of economics and finance. You needed to understand the formal processes of decision-making. The road to leadership and profits was formal and conscious and an MBA embodied the type of training you needed to achieve both good leadership and financial outcomes.

This latter comprised an ability to understand and apply financial concepts and to put them into action. In this phase, the emphasis was on financial decision-making and formal skills to understand the linkages between finance, accounting and business decisions. So in this phase, the focus moved to financial engineering as the way to achieve the profits and outcomes demanded by the market. Training also includes formal business simulations as a way to reinforce formal training in business.

Impact on Leadership development: In this era, the focus is on how to get financial results which look good to the market, even if this might be at the expense of future results. The focus on financial engineering requires training in finance, preferably at the graduate level. The belief that people make decisions based on rational considerations leads to an emphasis on MBA training.

In leadership training, the emphasis becomes more business-focused and semi-vocational in nature. The emphasis moves from personality and interpersonal skills to the numerous competencies needed for professional leadership. However, since there is no formal model for business acumen, other than standard training in finance and economics, there is no direct link to business outcomes in these assessments so they are not very useful in predicting financial outcomes of particular individuals.

Business simulation became part of the answer in this stage. We can view business simulation as being part of the competency approach since it assumes that there are formal competencies which can be improved using this method.

It was decided in this phase that part of the problem in leadership is that, although executives have learned business and financial theories and might have good qualifications in these areas, they are not being demonstrated or tested in practice. In order to rectify this problem, they need to undergo simulations of business situations. So business simulations were introduced into business acumen training. This does rectify one set of issues, but there are other and different problems with business simulations.

Business simulations are effective at focusing on the conscious behaviors but not at linking the unconscious financial behaviors of people to the outcomes they will likely experience in practice. They can be effective in some situations but suffer from wider problems in execution.

In addition it has become e clear that business simulations suffer from the Hawthorne Effect, the phenomenon whereby we act differently to how we would act in practice if we know we are being observed. Business simulations are still used and can be effective but without major redesign will continue to suffer from these problems.

Stage 3 The Great Stagnation and Cognitive Leadership

Economic Environment: This phase starts with the fall of Lehman Brothers in 2008 and continues to this day. It is characterized by a long stagnation in all the developed economies and increasingly those in the developing world. The optimism of the boom and the skepticism bred by the busts has given way to pessimism and resignation. It has finally dawned on most people that there are no magic bullets for making money. Having strong economic or financial qualifications is no guarantee of success.

This stage might well continue for several generations. Writers such as Nouriel Roubini have shown that these crises are normal, not abnormal and are connected with the way that humans make decisions so unless we can make a fundamental change in behavior; we can expect to see more stagnation.

The emergence of behavioral economics and finance has led to a realization that many if not oust economics financial decisions are driven by conscious cognitive biases of which the vast majority of leaders and decision-makers are not aware. Since most universities do not yet teach behavioral economics or finance, this could go on for some time.

Impact on Business Acumen: So in this phase, “business acumen” has become integrally linked with the unconscious processes behind business and financial decision-making. This includes formal assessment so that decision-makers can see these biases and try to compensate for them

The financial crisis spurred multiple realizations about business acumen. First, it showed that even players who were smart, well-educated and understood finance well could and did, in the vast majority of cases, make egregious errors that made the crisis worse, as shown by companies such as McKinsey. The subsequent emergence of behavioral economics and finance was catalyzed by the realization that the players were subject to unconscious cognitive biases of which almost all were unaware. One of the main such biases was over-confidence. It has become clear that if we are smart and well-educated, we are actually more subject to these biases rather than less.

Impact on Leadership Development: The new paradigm for leadership development is a behavioral strategy, that is to understand the unconscious cognitive biases behind business and financial decisions. This requires formal assessments so that these biases can be understood and compensated for.

Also in leadership development, it is critical to focus on increasing the mental or leadership agility of leaders, so that they are open to understanding their cognitive biases, instead of being defensive about them and ignoring them, which makes things worse. We are starting to understand that sometimes too much knowledge is a bad thing. It has even become clear that having too much data can lead to worse decisions so we have to compensate for this phenomenon also.

It has taken some time for the Perth Leadership Institute and other researchers to put this all together. We are still working on extending these approaches.

Even though behavioral economics and finance – collectively the behavioral disciplines – have enormously extended our understanding, we are still in the formative stages of changing the way we train leaders. Although the behavioral disciplines have given us new insights, we can already see a number of problems with them. Perth is actively working in this area to extend the power of the new behavioral approaches and make them even more useful to leaders and executives.

The past personality, competency (and related business simulation) approaches have been and continue to be very powerful. They have brought us this far. But, in line with Schumpeter’s theory of creative destruction, some of their cherished assumptions have to be modified or even eliminated in order for the field to make progress.

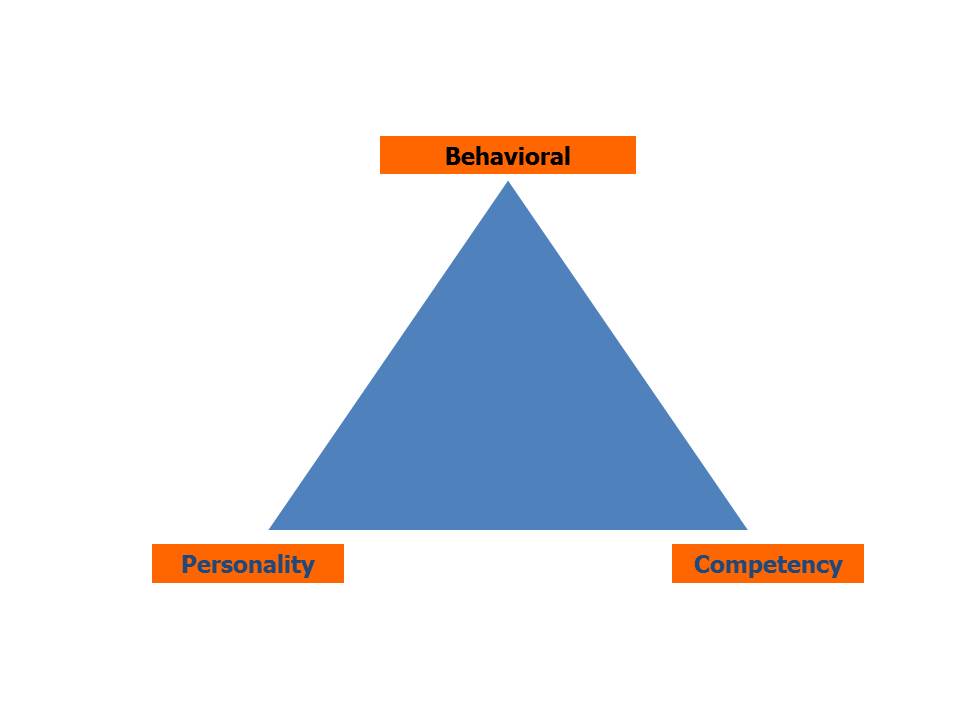

At this stage though, for any organization to provide business acumen development and leadership training, and to integrate business acumen at the level of refinement that we have achieved up til now, we can say that we need to integrate three separate but linked approaches. These are the personality, competency and behavioral approaches. We have set these out in the following diagram.

The behavioral approaches seen in this diagram integrate business acumen assessments which focus on identifying and measuring the unconscious cognitive biases that drive business outcomes without us being aware. These results must be integrated into the results we obtain from personality and competency approaches. It is these assessments that the Perth Leadership has developed and which, so far, are unique in the field.